Save. Borrow. Grow.

Learn. Earn. Invest.

The more you know, the more you’ll grow. Let us help. Our interactive Financial Education Center is designed for members of all ages.

Learn How you should get started or optimize your retirement plan!

Learn how to be more financially prepared in the years ahead.

Learn how to manage your money and avoid financial dangers.

Convenience You’ll Love

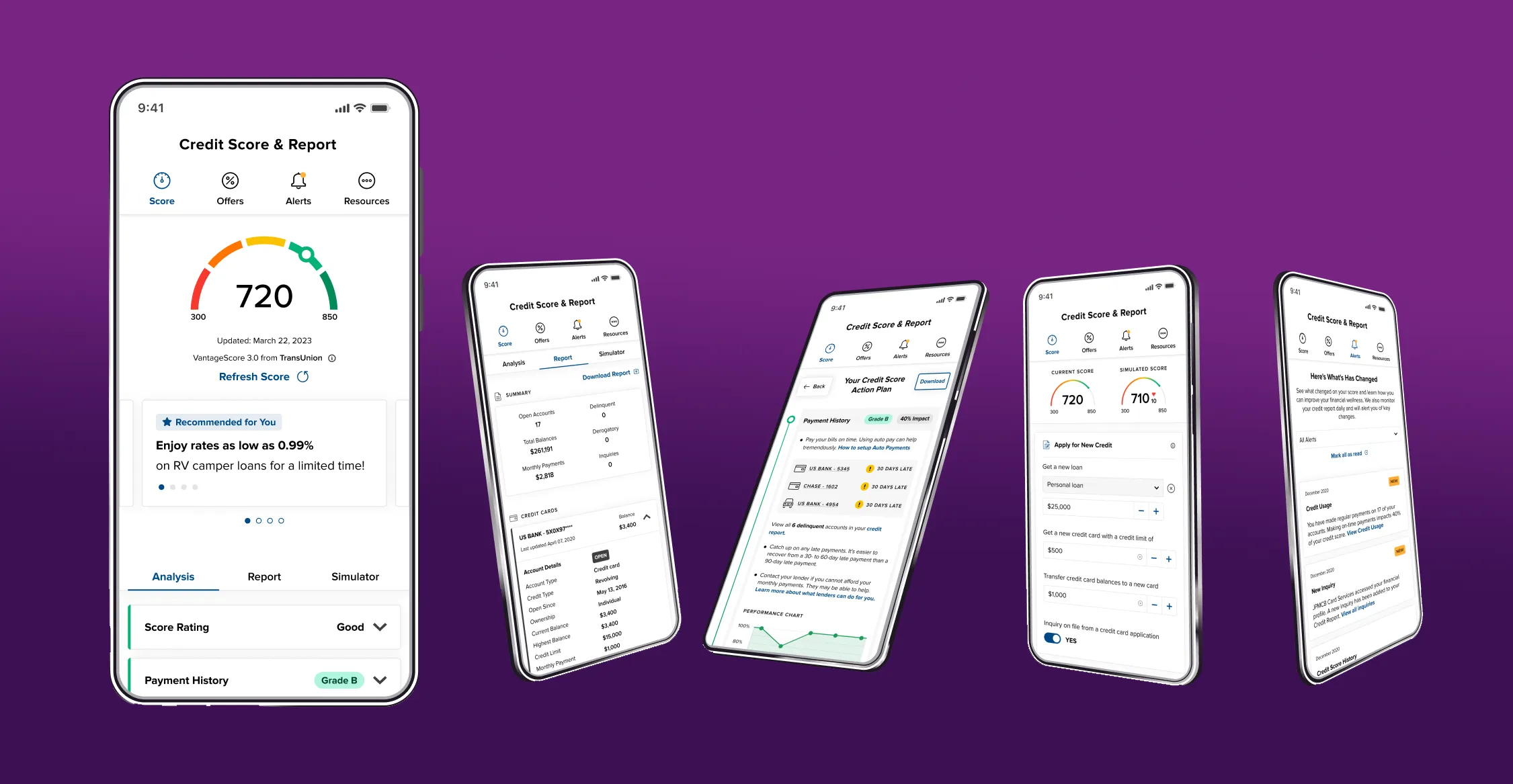

Visiting a branch isn’t always convenient. We get it. That’s why we offer numerous online and mobile banking solutions. Access your accounts. Transfer funds. Use Apple Pay. Sign up for text alerts. It’s up to you. Choose the options that best fit your lifestyle.

Recent Blog Posts

At Member One, we’ll be your navigation system as you explore curated e-learning playlists designed to help you chart your financial odyssey and steer towards financial independence.

Virginia Credit Union, Inc. (VACU) and Member One Federal Credit Union (Member One) are excited to announce their plans to merge pending regulatory approval and a positive Member One membership vote.

Dating in the digital age doesn't come without dangers to be aware of.

Find exactly what you need when you need it!